Enhanced Unemployment

The CARES Act provides an additional $600 per week for those receiving unemployment insurance (UI). This $600 is in addition to the weekly unemployment benefit you receive from your state. The $600 supplement is paid for four months or until July 31, 2020.

- Through December 31, 2020 the law provides an additional 13 weeks of unemployment benefits for people who are still unemployed after exhausting their state benefits. This means most workers will have a total of 39 weeks of unemployment benefits.

- The CARES Act also gives states federal funds to pay the cost of the first week of unemployment benefits if your State chooses to pay recipients as soon as they become unemployed.

- The law expands eligibility for UI benefits to individuals who currently may not receive traditional UI, including workers with limited work histories, the self-employed individuals, independent contractors, “gig” workers, and those who have exhausted normal UI benefits. However, such workers must be unemployed because of the effects of the coronavirus, including their own illness, illness of a family member, the need to quarantine, job loss because of the virus, and staying home to take care of a child.

- Those who can telework, and those receiving paid leave are excluded.

- States have discretion as to whether they participate in the expanded UI regime created by the CARES Act. Your state unemployment insurance office will also be the source for questions about issues such as:

- The maximum payout per week.

- When the extra $600 UI payment takes effect.

- If the state waived the one-week waiting period for UI benefits.

- If your state allows short-time compensation arrangements.

For more information on the enhancements the CARES Act made to UI, go here.

FFCRA Paid Sick Leave and Extended Family Medical Leave

Recent legislation creates two new paid sick leave requirements, the “Emergency Paid Sick Leave Act” (“Paid Leave”) and the “Emergency Family and Medical Leave Expansion Act” (“FMLA Leave”). These leave provisions do not apply to you if you have been laid off.

While an employee is taking Paid Sick Leave or FMLA Leave, an employer must maintain the employee’s health coverage. In other words, the employer must make contributions to the H&W Plan for each hour of paid sick leave under either Act.

The FFCRA is silent on whether contributions must be made to other fringe benefit funds. That issue will be governed by the language of the applicable collective bargaining agreement.

Your employer should know that, in essence, both paid leave programs are funded by the federal government. Thus, for every dollar an employer pays to its employees under these programs (up to the applicable daily limits described below), the employer gets a credit against its payroll taxes otherwise due.

Paid Leave

- This Act requires employers to provide paid sick leave to employees who are unable to work for any one of six reasons related to the coronavirus. These grounds are that the employee:

- Is subject to a federal, state, or local quarantine or isolation order related to coronavirus;

- Has been advised by a health care provider to self-quarantine due to concerns related to coronavirus;

- Is experiencing symptoms of coronavirus and is seeking a medical diagnosis;

- Is caring for an individual who is subject to an order as described in the first bullet above, or who has been advised as described in the second bullet above;

- Is caring for his or her son or daughter whose school or place of care has been closed or whose child care provider is unavailable due to coronavirus related reasons; or

- Is experiencing any other substantially similar condition specified by the Secretary of Health and Human Services in consultation with the Secretary of the Treasury and the Secretary of Labor (Secretary).

FMLA Leave

- Private employers with fewer than 500 employees, as well as all public agencies, must provide Paid Leave.

- The DOL may exempt certain employers with fewer than 50 employees from providing paid sick leave for child care.

- Paid Leave applies regardless of how long the employee has worked for the employer.

- Full-time employees are entitled to 80 hours of Paid Leave. Part-time employees are entitled the number of hours that they work on average over a two-week period.

- An employee directly affected by COVID (the first three bullets above) must receive his or her regular rate of pay, up to $511 per day ($5,110 in the aggregate over the two week period).

- An employee who takes Paid Leave to caring for someone other than themselves (such as a child whose school is closed) is entitled to be paid two-thirds of his or her regular rate, up to $200 per day ($2,000 in the aggregate).

- In both cases, the employer can pay more than is required, but the tax credit that the employer receives is limited to the applicable cap.

- An employer may not require an employee to use other paid leave provided by the employer before the employee uses the EPSLA paid sick leave, nor may an employer condition EPSLA sick leave on the employee searching for or finding a replacement employee to cover the hours during which the employee is using paid sick leave.

- The EPSLA prohibits employers from discharging, disciplining, or otherwise discriminating against an employee who takes paid sick leave under the EPSLA, files any complaint under or relating to the EPSLA, institutes any proceeding under or relating to the EPSLA, or testifies in any such proceeding.

- This Act requires employers to provide expanded paid family and medical leave to eligible employees who are unable to work because the employee is caring for a son or daughter.

- It applies to private employers with fewer than 500 employees, although DOL may exempt employers with fewer than 50 employees if providing FLMA Leave would “jeopardize the viability of the business as a going concern.”

- An employee must have been employed by the employer for at least 30 calendar days to be eligible.

- Employees who were laid off or terminated on or after March 1, 2020, and had worked for the employer for at least 30 of the prior 60 calendar days, are eligible if they are rehired by the same employer.

- An employee is entitled to take up to twelve weeks of FMLA Leave.

- The first two weeks are unpaid, although an employee may use the Paid Leave described above for these two weeks.

- After the first two weeks, the employee must be paid at two-thirds of his or her regular rate of pay, up to $200 per day.

For more information on the FFCRA paid leave and expanded family leave provisions as interpreted by the DOL, go here.

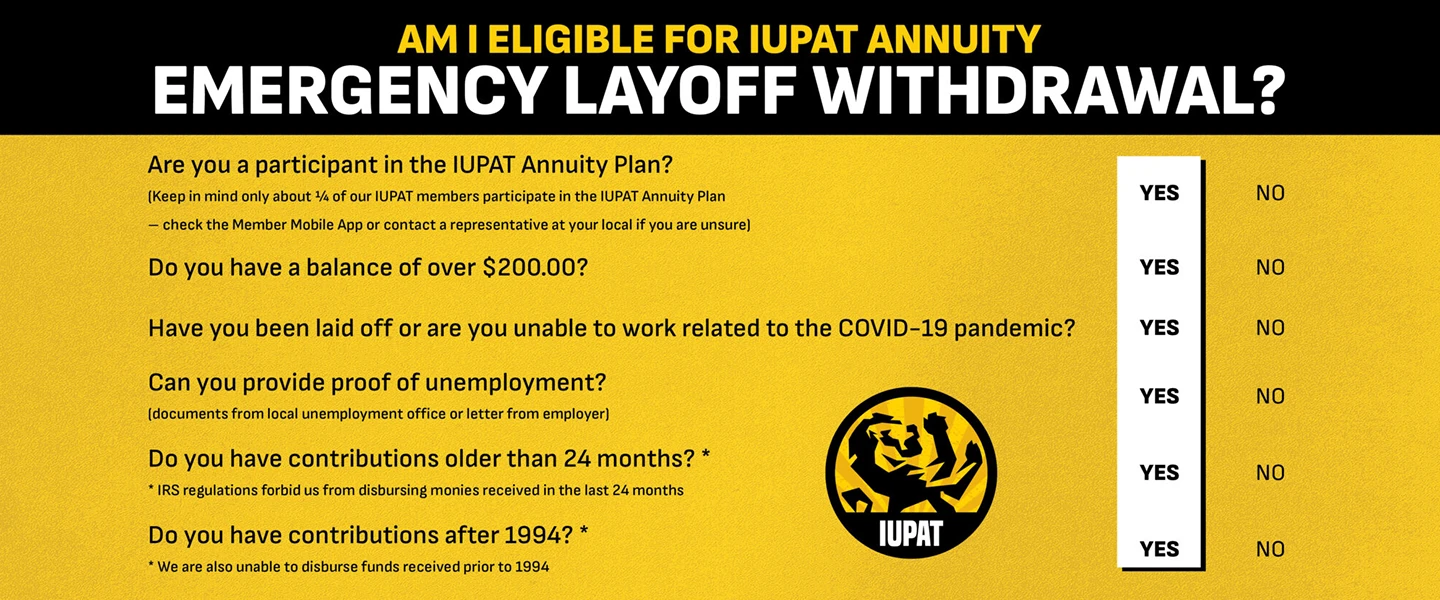

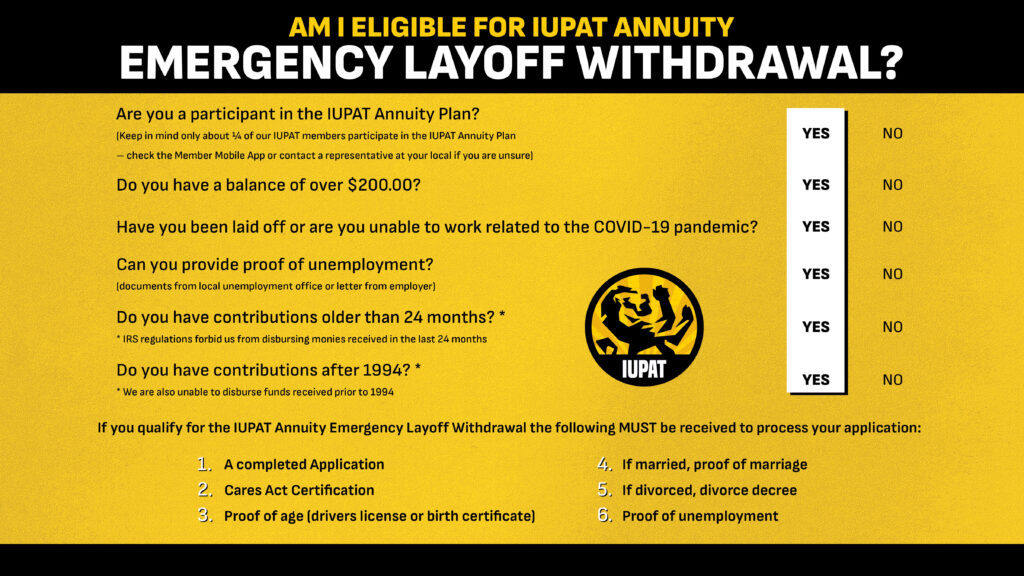

Retirement Plan Changes

The CARES Act allows individuals who have experienced adverse financial consequences as a result of the coronavirus pandemic to make withdrawals of up to $100,000 from their defined contribution retirement funds without having to pay the 10% early withdrawal penalty.

- The withdrawal must be made because of adverse financial consequences experienced as a result of the individual (or his or her spouse or dependent) contracting coronavirus, or because of related factors — such as the coronavirus forcing the individual to be quarantined, the pandemic causing the individual to be furloughed or laid off, or because he or she can’t work due to lack of child care.

- Income attributable to such a withdrawal is subject to tax over three years, and individuals could may recontribute funds to their retirement plans within three years.

The CARES Act also allows individuals to make loans against certain retirement plans if they have experienced adverse financial consequences from the pandemic.

- Note that when loans are made against retirement funds, the retirement funds themselves remain invested and can benefit from market growth.

For more information on the changes the CARES Act made to retirement plans, go here.

If you are a participant in the Painters and Allied Trades Industry Pension Plan for U.S. Employees (the national plan), you can find more information on how to receive a distribution or loan here.

Recovery Act Checks

The CARES Act provides economic recovery checks of $1,200 for most adults with up to $75,000 in adjusted gross income (or AGI of $112,500 for heads of household and $150,000 for married couples filing jointly). There is an additional $500 for each child.

- The check amount is reduced by $5 for each $100 in income that you have above these thresholds.

- For those with incomes above $99,000 (or $146,500 for heads of household with one child, and $198,000 for joint filers with no children), the rebate is phased out entirely.

- The recovery check amount is determined based on your 2019 income tax return but it will be advanced based on your 2018 tax return if you have not filed a 2019 return.

- If your 2020 income is higher than the 2018 or 2019 income used to determine the rebate payment, you will not be required to pay back any excess rebate.

- However, if your 2020 income is lower than the 2018 or 2019 income used to determine the rebate payment, you will be able to claim an additional credit when you file your 2020 income tax return.

- You must have a work-eligible Social Security number to be eligible.

- Non-resident aliens are not eligible.

- Individuals who are dependents of another taxpayer are not eligible.

- If you have a bank account on file with IRS to receive normal refunds, these payments will be direct deposited into that account with no additional action required by you.

- If you do not e-file or do not receive your refund payments electronically, the IRS will be issuing paper checks through the U.S. mail. That will take longer

- The IRS says it will be making a website available where you can upload your direct deposit information so that you can receive the payments electronically.

- One final word. Do not get scammed. The IRS will never—even in normal times—call, text, email, or Facebook message you nor will it ever request personal or financial information. EVER.

Additional information about the CARES Act economic recovery checks is available here.

The DOL’s April 6th temporary rule implements each of the requirements of the EPSLA and the EFMLEA and adds important details and clarifications regarding these provisions of the FFCRA.

For more information on the FFCRA paid leave and expanded family leave provisions as interpreted by the DOL, go here.

Federal Tax Filing and Payment Extensions

The CARES Act extends both the federal income tax filing date and payment date from April 15, 2020 to July 15, 2020.

- Tax payments due on April 15, 2020 can be deferred to July 15, 2020, without penalties and interest, regardless of the amount owed.

- This deferment applies to all taxpayers.

- Taxpayers do not need to file any additional forms or call the IRS to qualify for this automatic federal tax filing and payment relief.

- Individual taxpayers who need additional time to file beyond the July 15 deadline, can request a filing extension by filing Form 4868.

Additional information on the delay of federal tax filing and payment deadlines is available here, and a list of FAQs can be found here.

Additional information on what states are delaying state tax filing and/or payment deadlines is available here.

Mortgage Relief

The CARES Act prohibits mortgage lenders from foreclosing on any federally-backed mortgage for a 60-day period following March 18, 2020.

- This covers mortgages insured or guaranteed by HUD, Fannie Mae, Freddie Mac, the Veterans Affairs Department, and the Agriculture Department.

- The law also authorizes borrowers experiencing hardship as a result of the coronavirus pandemic to request up to 180 days forbearance on their mortgage payments. No documentation is required. You only need to claim financial hardship due to COVID-19.

- If needed, an additional forbearance period of up to 6 months may be requested by the borrower, but this musst be approved by the mortgagee.

For more information on the mortgage relief in the CARES Act, go here and here.

Tenant Eviction Protections

The CARES Act prohibits landlords from requiring a tenant to vacate or from commencing eviction procedures for nonpayment of rent, for 120 days after March 27, 2020. The provision only applies to multi-family properties where the landlord’s mortgage is insured, guaranteed, supplemented, or protected by federal agencies or programs.

- If you are subject to an eviction, you need to find out if this Act provides a defense to you.

For more information on the tenant relief in the CARES Act, go here.

Consumer Credit Relief

The CARES Act prohibits banks, lenders, and other entities that provide information to credit reporting agencies from treating a deferment, partial payment, or a credit forbearance requested by a consumer as a result of the coronavirus pandemic as negative credit information.

- This provision only apply to consumers who fulfill all terms and requirements of a forbearance or modified payment agreement.

- The prohibition will remain in place until 120 days following the end of the declared COVID-19 national emergency.

Additional information on the consumer credit relief provisions of the CARES Act is available here.

Student Debt Relief

The CARES Act defers student loan payments, principal, and interest through September 30 for all borrowers of federally owned loans.

- People who drop out of school because of the pandemic will not be required to return portions of any Pell Grants or federal loans they received.

- If students drops out due to the pandemic, the current academic term doesn’t count toward their lifetime eligibility limit for receiving Pell Grants or subsidized federal loans.

For more information on federal student debt relief provisions of the CARES Act, go here.